Staying informed about the latest financial news is crucial for making smart investment decisions. Whether you’re seeking investment advice, managing your wealth through wealth management strategies, or planning for retirement with financial planning for retirees, understanding how current events affect the markets can help you protect and grow your portfolio. In this article, we’ll explore how recent financial news could impact your investments and what steps you can take to stay ahead. We’ll also discuss the role of stock market index funds and tax planning services in navigating these changes.

Why Financial News Matters for Investors

Financial news provides valuable insights into market trends, economic policies, and global events that can influence investment performance. From interest rate changes to geopolitical tensions, these factors can create both risks and opportunities for investors. By staying informed, you can make timely adjustments to your portfolio and avoid potential pitfalls. For example, understanding how inflation impacts stock market index funds or how tax law changes affect your retirement savings can help you make more informed decisions.

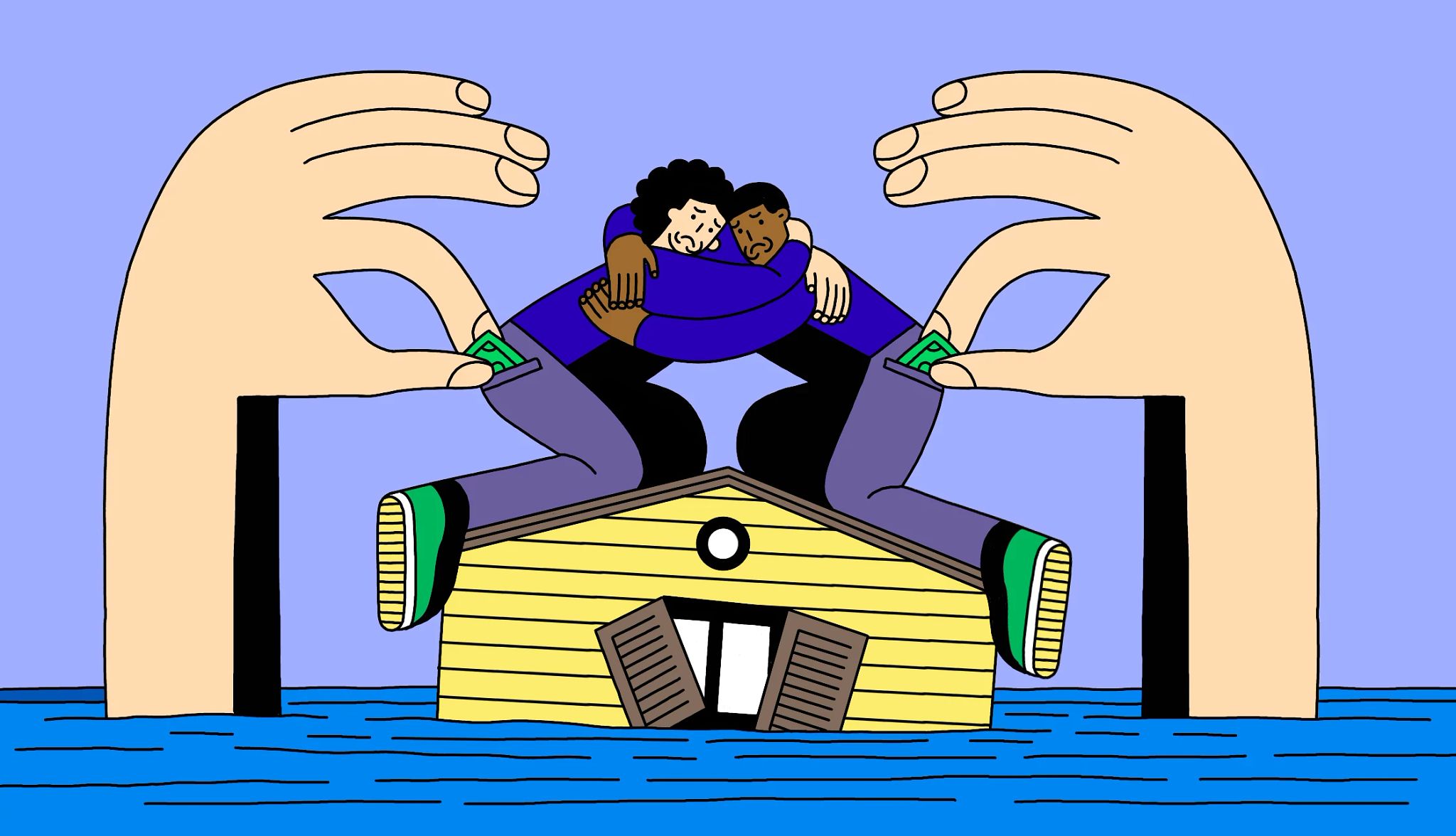

Image: An investor staying updated with financial news to make informed decisions.

1. Interest Rate Changes and Their Impact

One of the most significant pieces of financial news in 2025 is the potential for interest rate changes by central banks. Higher interest rates can impact various aspects of your investments:

- Bonds: Rising interest rates typically lead to lower bond prices, which can affect the value of your fixed-income investments.

- Stocks: Higher borrowing costs can reduce corporate profits, potentially leading to lower stock prices.

- Real Estate: Increased mortgage rates can slow down the housing market, impacting real estate investments.

To mitigate these risks, consider diversifying your portfolio with stock market index funds, which offer broad market exposure and can help balance the impact of interest rate changes.

2. Inflation Trends and Investment Strategies

Inflation remains a key concern for investors in 2025. Rising prices can erode purchasing power and reduce the real returns on your investments. Here’s how you can protect your portfolio:

- Invest in Inflation-Protected Securities: Treasury Inflation-Protected Securities (TIPS) and other inflation-linked bonds can help safeguard your investments.

- Focus on Growth Stocks: Companies with strong pricing power and growth potential may perform better in an inflationary environment.

- Consider Real Assets: Real estate and commodities like gold often perform well during periods of high inflation.

Working with a professional who offers investment advice can help you develop a strategy tailored to your financial goals.

3. Geopolitical Events and Market Volatility

Geopolitical events, such as trade disputes, elections, and conflicts, can create market volatility and uncertainty. Here’s how to navigate these challenges:

- Diversify Your Portfolio: A well-diversified portfolio can help reduce the impact of market swings caused by geopolitical events.

- Stay Informed: Regularly monitoring financial news can help you anticipate potential risks and adjust your strategy accordingly.

- Focus on Long-Term Goals: Avoid making impulsive decisions based on short-term market movements. Stick to your long-term investment plan.

Incorporating wealth management strategies can provide additional stability and help you stay focused on your objectives.

4. Tax Law Changes and Retirement Planning

Changes in tax laws can have a significant impact on your investments, especially if you’re planning for retirement. Here’s what to watch for in 2025:

- Roth IRA Conversions: Converting traditional IRA funds to a Roth IRA can provide tax-free income in retirement, especially if tax rates rise.

- Capital Gains Taxes: Changes to capital gains tax rates could affect your investment strategy, particularly for taxable accounts.

- Estate Tax Exemptions: Updates to estate tax laws may impact your wealth transfer plans.

Consulting with tax planning services can help you navigate these changes and optimize your retirement savings.

5. The Role of Technology in Investing

Technological advancements continue to shape the investment landscape, offering new tools and opportunities for investors. Here are some trends to watch in 2025:

- AI-Powered Investment Platforms: These platforms use artificial intelligence to analyze market data and provide personalized recommendations.

- Blockchain and Cryptocurrencies: Blockchain technology is transforming industries, and cryptocurrencies are becoming a more mainstream investment option.

- Robo-Advisors: Automated investment platforms are making wealth management more accessible and affordable.

By leveraging these technologies, you can gain a competitive edge and make more informed investment decisions.

6. Financial Planning for Retirees

For retirees, staying informed about financial news is especially important, as market changes can directly impact your income and savings. Here are some strategies to consider:

- Adjust Your Withdrawal Rate: If market conditions are unfavorable, consider reducing your withdrawal rate to preserve your savings.

- Review Your Asset Allocation: Ensure your portfolio is aligned with your risk tolerance and financial goals.

- Explore Annuities: Annuities can provide a steady stream of income during retirement, helping to mitigate market risks.

Working with a professional who specializes in financial planning for retirees can help you navigate these challenges and ensure a secure retirement.

7. The Importance of Staying Proactive

In a rapidly changing financial landscape, staying proactive is key to protecting and growing your investments. Here are some steps you can take:

- Regularly Review Your Portfolio: Assess your investments periodically to ensure they align with your goals and risk tolerance.

- Stay Educated: Continuously educate yourself about market trends and investment strategies.

- Seek Professional Advice: Working with a financial advisor can provide valuable insights and help you make informed decisions.

By staying proactive, you can adapt to changing market conditions and achieve long-term financial success.

Conclusion

The latest financial news can have a significant impact on your investments, but staying informed and proactive can help you navigate these changes effectively. Whether you’re seeking investment advice, managing your wealth through wealth management strategies, or planning for retirement with financial planning for retirees, understanding current events is crucial for making smart decisions. Additionally, leveraging tools like stock market index funds and consulting with tax planning services can help you optimize your portfolio and achieve your financial goals. Stay informed, stay proactive, and take control of your financial future.