Description: Discover how to secure the best mortgage rates in 2025 by understanding the current market trends, exploring different loan options, and utilizing expert tips to minimize your borrowing costs.

Introduction

Mortgage rates in 2025 are expected to present both opportunities and challenges for homebuyers and refinancers. As the housing market continues to evolve, securing the lowest possible mortgage rate is a top priority for many. Whether you're a first-time homebuyer or looking to refinance your existing mortgage, understanding the factors that influence rates and knowing how to compare options effectively can save you thousands of dollars over the life of your loan.

Understanding Mortgage Rates in 2025

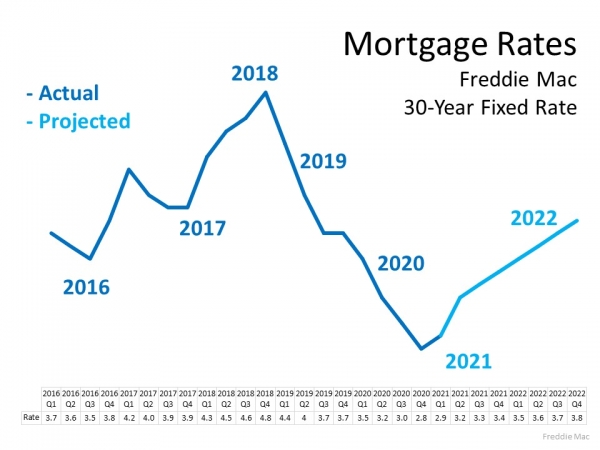

Mortgage rates are influenced by a variety of economic factors, including inflation, employment trends, and monetary policy. In 2025, experts predict that rates may remain relatively stable, but fluctuations could occur depending on broader economic conditions. Monitoring these factors and staying informed about market trends is essential to timing your mortgage application effectively.

One key factor to consider is the difference between fixed-rate and adjustable-rate mortgages (ARMs). Fixed-rate mortgages offer the advantage of stable monthly payments, making them ideal for long-term homeowners. On the other hand, ARMs may offer lower initial rates, which can be appealing for those planning to sell or refinance within a shorter timeframe. Understanding which option aligns with your financial goals is crucial.

The Role of Credit Scores

Your credit score plays a significant role in determining the mortgage rate you qualify for. Lenders view credit scores as an indicator of your financial reliability, and higher scores often lead to lower interest rates. Before applying for a mortgage, it's wise to review and improve your credit score by paying off debt, avoiding new credit applications, and ensuring accurate reporting on your credit reports.

In 2025, maintaining a strong credit score will be more important than ever, as lenders may become more selective in their approval processes. By addressing any credit issues in advance, you position yourself to secure the most favorable terms when you're ready to apply.

Shopping Around for the Best Rates

One of the most effective strategies for finding the lowest mortgage rates is to shop around. Different lenders may offer varying rates based on their funding costs, competition, and target market. By comparing multiple offers, you can identify the lender that provides the best combination of low rates, favorable terms, and excellent customer service.

To streamline the process, consider using online comparison tools or contacting multiple lenders directly. Many lenders now offer pre-approval services, which can give you a clear idea of your borrowing capacity and the rates you qualify for. This pre-approval can also strengthen your position when making an offer on a home.

Exploring Refinancing Options

If you already own a home and are considering refinancing, 2025 could be an opportune time to lock in a lower rate. Refinancing involves replacing your existing mortgage with a new loan, ideally at a lower interest rate. This can reduce your monthly payments and save money over the life of the loan.

Before refinancing, it's important to assess the costs involved, such as closing costs and appraisal fees, to ensure that the long-term savings outweigh the upfront expenses. Additionally, evaluate how long you plan to stay in your home, as refinancing is most beneficial for those who intend to hold the property for several years.

Utilizing Technology and Tools

In 2025, technology will continue to play a pivotal role in the mortgage process. Many lenders now offer digital platforms that allow you to compare rates, submit applications, and track the status of your loan from the comfort of your home. These tools not only save time but also provide greater transparency into the process.

Moreover, mortgage rate calculators are invaluable for estimating your monthly payments and understanding how different rates affect your overall borrowing costs. By experimenting with various scenarios, you can make a more informed decision about which loan structure suits your financial situation best.

Conclusion for Part 1

Securing the best mortgage rates in 2025 requires a combination of knowledge, preparation, and strategic planning. By understanding the factors that influence rates, improving your credit score, and shopping around for the best offers, you can position yourself to achieve your homeownership goals at the lowest possible cost. In the next section, we'll delve deeper into specific strategies for comparing lenders, negotiating terms, and staying ahead of market trends.

Part 2: Advanced Strategies for Securing the Best Mortgage Rates

In the second part of our guide to finding the best mortgage rates in 2025, we’ll explore additional strategies for securing favorable terms, staying ahead of market changes, and ensuring a smooth application process. Whether you're a first-time buyer or refinancing, these tips will help you navigate the mortgage landscape and make informed decisions.

Comparing Lenders: More Than Just Rates

While searching for the lowest mortgage rate, it's easy to focus solely on the interest rate. However, the overall terms and conditions of the loan are equally important. Different lenders may charge varying amounts for origination fees, discount points, and closing costs, which can significantly impact your total borrowing cost.

When comparing lenders, create a detailed side-by-side comparison that includes not only the interest rate but also all associated fees. This will give you a clearer picture of which lender offers the most cost-effective solution. Additionally, consider the lender's reputation for customer service, as a responsive and reliable lender can make the application process much smoother.

Negotiating with Lenders

Don’t hesitate to negotiate with lenders to secure better terms. Many lenders are willing to adjust rates or fees to attract borrowers, especially during periods of high competition. If you’ve received multiple offers, use these as leverage to negotiate a better deal.

For example, if one lender offers a slightly higher rate but lower fees, you could ask if they’re willing to match a competitor’s rate in exchange for a higher fee. Alternatively, you might request waived fees for closing costs or other expenses. The key is to approach negotiations with confidence and a clear understanding of your options.

Monitoring Market Trends

Mortgage rates in 2025 are likely to be influenced by broader economic trends, such as changes in the Federal Reserve’s interest rate policy, inflation rates, and housing market conditions. Staying informed about these trends can help you time your application to coincide with favorable rates.

Consider following financial news outlets, subscribing to mortgage rate alerts, or consulting with a financial advisor to stay updated on market developments. By being proactive, you can identify windows of opportunity and act swiftly to secure the best rates.

Locking In Your Rate

Once you’ve found a lender and agreed on terms, a rate lock is essential to protect yourself from potential rate increases. A rate lock freezes your interest rate for a specified period, typically 30, 45, or 60 days, giving you peace of mind as you finalize your transaction.

However, it’s important to understand the terms of your rate lock agreement. If unexpected delays occur, you may need to extend the lock period, which could come with additional costs. Always review the terms carefully and communicate openly with your lender to avoid surprises.

Preparing Your Application

A well-prepared mortgage application not only increases your chances of approval but also helps you secure better rates. Gather all necessary documents, including proof of income, employment verification, and bank statements, well in advance. Ensure that your financial records are accurate and up-to-date, as discrepancies can delay the process or lead to unfavorable terms.

Additionally, avoid making any major financial decisions, such as switching jobs or taking on new debt, during the application process. These actions could impact your credit score or debt-to-income ratio, potentially leading to higher rates or even denial of your application.

Considering FHA and VA Loans

If you're eligible for government-backed loans, such as FHA or VA loans, they may offer more favorable rates and terms compared to conventional mortgages. FHA loans are designed for borrowers with lower credit scores or smaller down payments, while VA loans provide benefits for military service members and veterans.

Researching these options can open up new possibilities for securing competitive rates. Lenders offering FHA or VA loans often have specific guidelines, so it’s important to consult with a knowledgeable lender to determine if these programs align with your financial situation.

Final Thoughts for Part 2

Finding the best mortgage rates in 2025 requires careful planning, thorough research, and a willingness to explore all available options. By comparing lenders, negotiating terms, and staying informed about market trends, you can navigate the mortgage process with confidence and secure a loan that meets your needs.

Remember, the key to success lies in preparation and persistence. Don’t be afraid to ask questions, seek advice, and take the time necessary to find the right mortgage for your circumstances. With the right approach, 2025 offers a promising opportunity to secure low rates and achieve your homeownership goals.